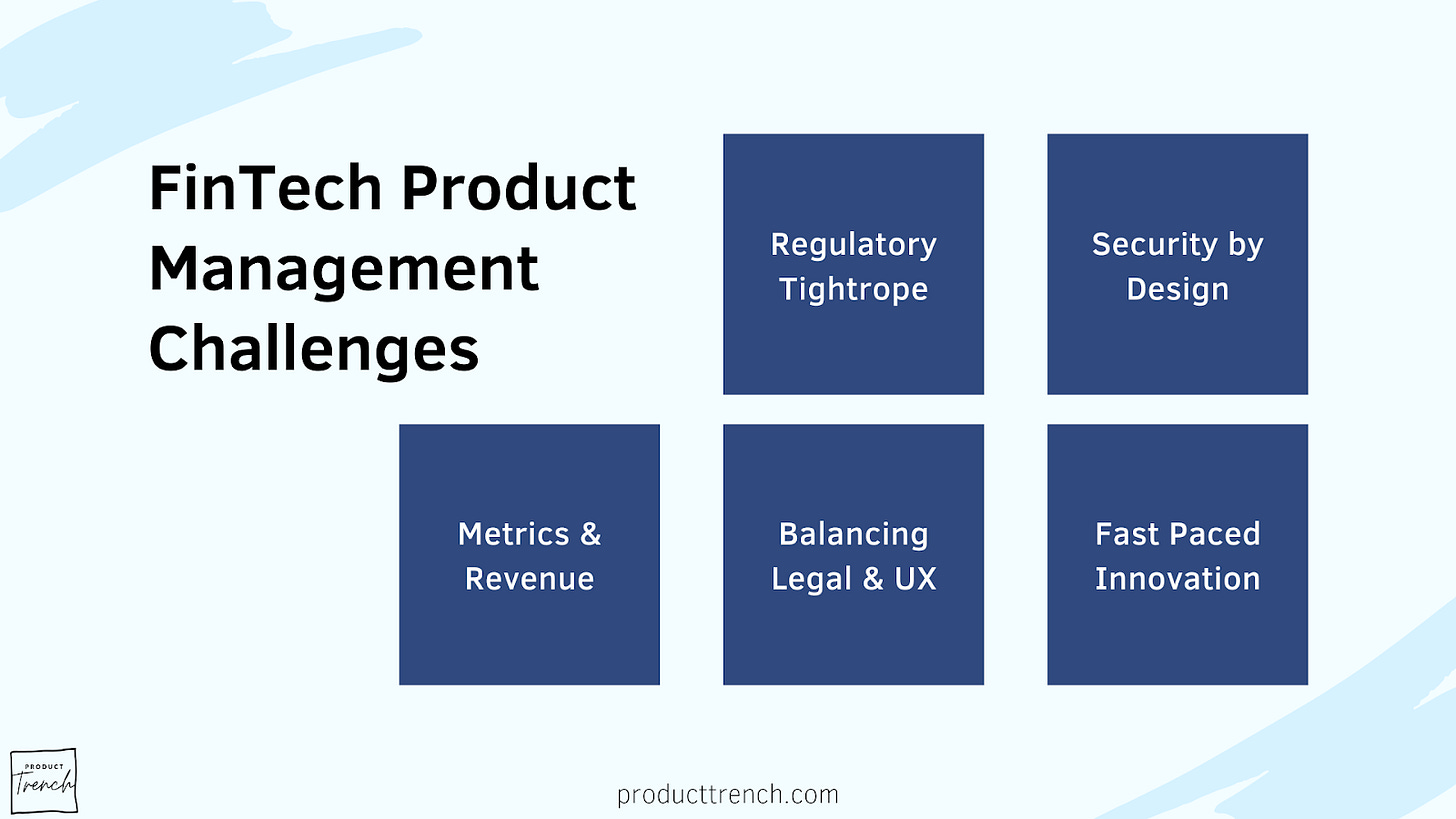

The Unique Challenges of FinTech Product Management

Why building in FinTech is a different game. From regulatory hurdles to trust-building metrics

Intro

What happens when your product crosses into the world of finance and sensitive data? Suddenly, you're not just building features—you’re managing risks, ensuring compliance, and safeguarding customer trust at an entirely new level. FinTech product managers have been mastering these high-stakes challenges for years. But now, as financial services become integrated into more industries—from AI-driven tools to healthcare apps—these same pressures are becoming relevant for product managers everywhere.

This week we have a guest with us, Sam Kawsarani, VP of Product at Paramount Commerce, the leading provider of pay-by-bank technology. Sam has been in the trenches of FinTech since 2011, building B2B products across various sectors, from payments and lending to investing and financial data aggregation.

Sam will share his insights on the changes for product managers when your product starts handling finance and sensitive data.

Let’s get straight to Sam and learn about the challenges of FinTech product management.

Sam here 👋

I joke by telling people I've been trying to leave FinTech for the past 5 years. Every time I am close to leaving, it yanks me right back in and locks the door. I get typecasted for FinTech roles despite considering myself a generalist, a generalist in the same industry since the financial crisis (we can't keep track of them anymore).

Welcome to FinTech, a world where trust is your currency, compliance is your best friend, and a misplaced decimal can send you straight into a regulatory nightmare.

What's FinTech?

FinTech, short for financial technology, is a broad term that encompasses a range of applications and services designed to enhance or automate financial services. It is more than just a buzzword. It's a transformative force reshaping how we interact with money. Whether it's the app that lets you instantly split a dinner bill with friends or a platform that allows any business to offer financing, FinTech is about making financial services more accessible, efficient, and user-friendly.

FinTech comes in many flavors. You've got payment solutions like Square and Stripe, financing platforms like Klarna and Affirm, wealth management tools like Betterment, and even insurance disruptors like Lemonade (sorry, InsurTech for the die-hard fans). Each segment operates in a unique space, but they all share one common challenge: navigating the treacherous waters of financial regulations.

The regulatory tightrope (a.k.a The ultimate buzzkill)

Imagine trying to innovate while wearing a straitjacket. That's FinTech product management in a nutshell. Regulations like Anti-Money Laundering (AML) and Know Your Customer (KYC) are just the tip of the iceberg. For every cool feature you want to roll out, a lawyer is telling you why it might land you in hot water. Compliance isn't just a checkbox; it's a full-time job. Miss one step, and you're not just delaying a product launch, you're potentially facing fines or even shutdowns. So, if you think you can move fast and break things, think again.

If you're telling yourself, "Boy, I'm lucky I don't have to deal with this," think twice. These regulations might still affect you even if you're not in FinTech. As products across industries increasingly handle financial transactions or sensitive user data, understanding how AML and KYC processes work is becoming crucial. For example, if your product involves payment processing, digital identity verification, or any form of financial service, you must ensure you're compliant with these regulations. Even non-financial products may need to incorporate these safeguards to prevent fraud and build user trust.

Understanding the basics of how AML and KYC work can help you anticipate potential regulatory challenges and build features that meet legal requirements and enhance user trust. Whether you're in healthcare, retail, or tech, being proactive about compliance will save you from costly headaches down the road.

Let's nerd out a bit on this. AML and KYC regulations are designed to prevent financial crimes like money laundering and fraud. These regulations require FinTech companies to verify the identity of their users, monitor transactions for suspicious activity, and report anything that looks fishy. Sounds straightforward, right? Not quite.

These regulations vary widely by country and region, meaning a global FinTech product needs to comply with multiple sets of rules. What works in the U.S. might not fly in Europe or Canada. This adds a layer of complexity that you don't typically see in other industries.

And then there's the issue of regulatory sandboxes. Some countries offer these sandboxes as a way for FinTech companies to test new products in a controlled environment without having to comply with every regulation right away. While sandboxes can accelerate innovation, they also come with risks. You're essentially operating under temporary rules, and when the sandbox period ends, you need to be ready to fully comply with all regulations or face the consequences.

Security by design

Handling someone's money isn't like playing with Monopoly cash. Financial data is sensitive, and a breach can do more than just lose a few bucks; it can destroy trust. That's why in FinTech, security isn't an afterthought; it's baked into every layer of your product. From how you store information to how you authenticate users, safeguarding user data is as important as the product itself. Just one slip, and you're not only dealing with angry customers but also regulators who won't be too happy about it either.

Regulators can impose hefty fines, enforce operational restrictions, or even revoke your license if security isn't up to standard. They might require public disclosure of the breach, which could severely damage your reputation and lead to legal consequences. In short, a security breach isn't just a bad day at the office; it's a potentially business-ending event.

And then there’s the question of incident response. Even with the best security measures in place, breaches can still happen. FinTech companies need to have a robust incident response plan that outlines how they’ll react if their systems are compromised. This includes everything from containing the breach and notifying affected customers to cooperating with regulators and law enforcement.

Metrics and money: What success looks like in FinTech

In FinTech, measuring success and understanding how you make money go hand in hand, and both are a bit different from what you'd find in other industries.

In a typical SaaS or e-commerce business, you might focus on straightforward metrics like user engagement, conversion rates, or customer lifetime value (LTV). While these metrics are still important in FinTech, they don't tell the whole story. Revenue often comes from unique streams like transaction fees, interest rates, or even the money held temporarily before it's transferred, known as float income.

These revenue models require a different set of metrics to track success. For instance, you'll need to measure the total value of transactions processed (Gross Transaction Volume, GTV), average revenue per user (ARPU), or compliance metrics like the number of successful KYC verifications. Each of these metrics tells you something important about how well your product is doing financially and operationally.

Balancing what's legal and usable

Creating a slick user interface in FinTech isn't just about making things look pretty. It's about making sure that every click, swipe, and tap complies with regulatory standards. This balancing act is a unique challenge in FinTech.

How do you keep the user onboarding experience smooth without cutting corners on compliance? The answer usually involves a lot of creative problem-solving and, sometimes, a bit of compromise.

Good UX design isn't just a nice-to-have. It's crucial for building trust with users who might not be so tech-savvy or who have been burned by clunky interfaces in the past (cough, banks). In FinTech, UX is more than just aesthetics; it's about creating a seamless experience that inspires confidence in users. A poorly designed interface can make users feel unsure about the security of their financial data, leading to churn.

For example, let's say you're designing an onboarding flow for a new customer. You want it to be quick and painless, but you also have to collect a mountain of information to satisfy KYC requirements. The challenge is to do this without making the user feel like they're applying for a mortgage. It's a tightrope walk, and one misstep can either annoy your customers or land you in hot water with regulators.

But the challenge doesn't end with compliance. FinTech companies also need to design for accessibility. This means creating products that are easy to use for people with disabilities or those who are not tech-savvy. It's not just about ticking a box; it's about expanding your market by making your product usable for everyone. And in a highly competitive space like FinTech, this can be a key differentiator.

Keeping up with the pace

If you think the tech world moves fast, FinTech moves at warp speed (okay, I might be biased). Whether it's new technology like GenAI or shifting consumer behavior (primarily Gen Z), these are just a few of the trends driving this rapid pace of innovation. This means that as a product manager, you need to be agile, ready to pivot, and always on the lookout for the next big thing.

What else is new, right?

But here's the thing: with great speed comes great responsibility (yes, I quoted Spider-Man). In FinTech, you can't just roll out a half-baked feature and fix it later. Your customers' financial well-being depends on your product, so you need to be thorough, cautious, and deliberate, even when the pressure to innovate is immense.

Key skills for success in FinTech product management

Thriving as a product manager in FinTech requires a few extra skills beyond the basics in your Product Sense arsenal. Here are the top 3 that can set you apart:

Sidenote: I believe in generalist PMs, so naturally, a lot of these can be picked up if you have the right product management foundations.

Understanding Regulations: FinTech is a heavily regulated industry, so it's important to have a good grasp of the rules. Knowing about things like AML and KYC helps you make smart decisions that keep your product compliant and out of trouble.

Managing Risks: FinTech deals with money and sensitive data, so there's a lot at stake. Being able to spot potential risks, whether they're security issues or compliance concerns, and coming up with ways to manage them is crucial. This helps you avoid problems that could hurt your product or your users.

Being Comfortable with Data: FinTech runs on data, and as a product manager, you need to be comfortable working with it. Whether it's analyzing user behavior or tracking financial performance, understanding how to use data to make informed decisions is key to your success.

Wrapping it up

At the end of the day, trust is the most valuable asset a FinTech company has. People are trusting you with their money, their data, and sometimes even their livelihood. That's a huge responsibility, and it should never be taken lightly.

As a FinTech product manager, your job is to build and maintain that trust every day. It's not just about making sure your product works; it's about ensuring that it works reliably, securely, and in compliance with every regulation. You're not just building a product—you're building a relationship with your customers, one that's based on trust and confidence.

Think of it this way: if users start doubting whether their money is safe with you, or if they believe their personal information could be compromised, they'll leave faster than you can say "user churn." This is why compliance isn't just a legal requirement—it's a trust-building exercise. And in FinTech, trust isn't just nice to have; it's your lifeblood.

🙏Thank you to Sam

Thank you to Sam for sharing his insights on the challenges in FinTech product management!

You can subscribe to Sam’s substack, The Product Trench, or follow him on LinkedIn.

Connect to Amy on LinkedIn, Threads, and Instagram.